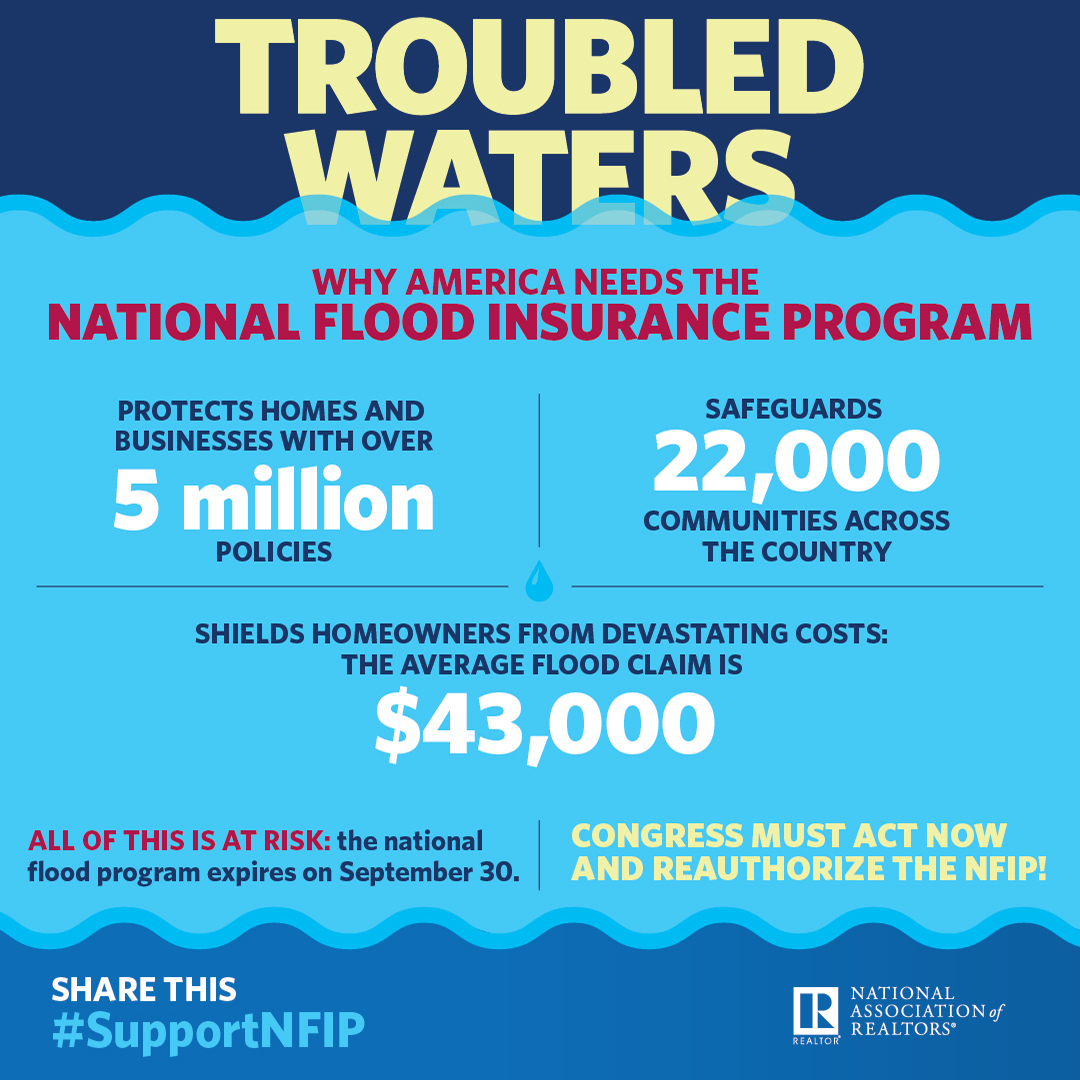

Communities voluntarily adopt and enforce floodplain management standards in order to participate in NFIP.All 50 states and some territories have experienced flooding since 2010.NFIP has 5.1 million policies in 22,381 communities, with $1.3 trillion in coverage.provide access to insurance for properties that might not otherwise be able to obtain it.reduce flood risk through adoption of floodplain management standards, and,.reduce federal expenditures on disaster assistance through insurance and mitigation,.The purpose of the National Flood Insurance Program (NFIP) is to:.

HIGHLIGHTSĭiane Horn, Analyst in Flood Insurance and Emergency Management, Government and Finance Division, Congressional Research Service (CRS)

With over 5 million flood insurance policies in force, the NFIP is the single largest source of flood insurance for homeowners and small businesses. NFIP requires participating communities to adopt and enforce minimum construction and land use regulations that make them less vulnerable to flooding. However, the NFIP is more than just an insurance program, it is also intended to be a floodplain management and flood risk mitigation program. Established by Congress in 1968, NFIP provides affordable, government-administered flood insurance to property owners, renters, and businesses. The Environmental and Energy Study Institute (EESI) held a briefing on the National Flood Insurance Program (NFIP).

0 kommentar(er)

0 kommentar(er)