It’s more than quadrupled this year and touched its highest level since 2008.

The two-year Treasury yield shot to 3.19% from 3.06% late Friday, its second straight major move higher. bond yields to their highest levels in years. It’s all a sharp turnaround from earlier in the pandemic, when central banks worldwide slashed rates to record lows and made other moves that propped up prices for stocks and other investments in hopes of juicing the economy. This advertisement has not loaded yet, but your article continues below. Those would come on top of some already discouraging signals about the economy and corporate profits, including a record-low preliminary reading on consumer sentiment that was soured by high gasoline prices.

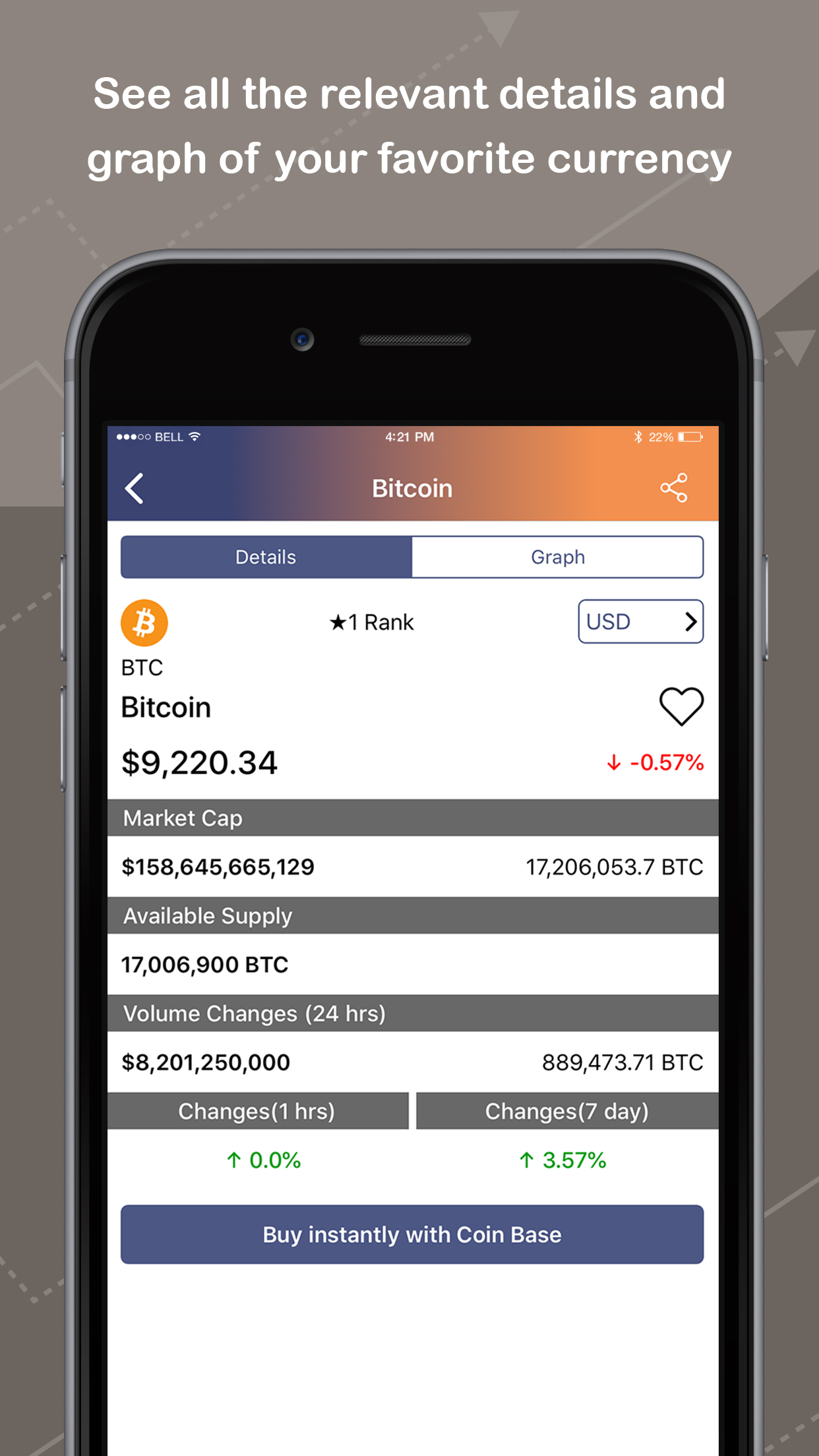

#Coins market series

No one thinks the Fed will stop there, with markets bracing for a continued series of bigger-than-usual hikes. Traders now see a nearly 33% probability of such a mega-hike, up from just 3% a week ago, according to CME Group. That’s triple the usual amount and something the Fed hasn’t done since 1994. Some traders are even speculating the Fed on Wednesday may raise its key short-term interest rate by three-quarters of a percentage point. With the Fed seemingly pinned into having to get more aggressive, prices tumbled for everything from bonds to bitcoin, from New York to New Zealand, with the biggest winners of the early pandemic often taking the heaviest hits. Its main method is to raise interest rates in order to slow the economy, a blunt tool that risks a recession if used too aggressively. The center of Wall Street’s focus was again on the Federal Reserve, which is scrambling to get inflation under control. Eastern time, and the Nasdaq composite was 2.9% lower. The Dow Jones Industrial Average was down 530 points, or 1.7%, at 30,876, as of 12:37 p.m. If USDD depegs further, it could trigger a downtrend for TRX.The S&P 500 dropped 2.4% in the first chance for investors to trade after getting the weekend to reflect on the stunning news that inflation is getting worse, not better. USDD is an algorithmic stablecoin for the Tron ecosystem, and TRX serves the same purpose as LUNA did to sustain the UST peg. The USDD algorithmic stablecoin is currently showing signs of stress, trading at a 1.1% discount from its dollar peg. Failure of the project to provide a solid solution could cause more losses. Since Celsius announced halting withdrawals, CEL has dipped by around 50%. One lesson from Terra is that once investors lose confidence in a project, selling pressure could trigger unimaginable losses. Some coins linked to the DeFi sector and those with weak fundamentals could fail to survive the bear crash. With Terra investors counting losses, Celsius users are worried about suffering the same fate. The decentralized finance sector is raising eyebrows because of the failure of some of the two largest projects in the field. Moreover, the collapse of Terra and the current issues with Celsius have only strengthened the argument of Bitcoin maxis that the asset is safer and more reliable than altcoins.Ĭryptoassets are a highly volatile unregulated investment product. The current selloff is affecting altcoins more than it is affecting Bitcoin.īitcoin’s dominance has increased to 45%, showing that it is occupying the market share left behind by crashing altcoins. Bitcoin has been through intense bear markets in the past, and it has always remained strong. Bitcoinīitcoin makes for a safe choice during bear markets. Therefore, the best cryptos to buy during the recent crash are those with strong technological backing. The current downtrend could trigger massive dips in coins that do not have strong fundamentals.

Coins to buy during the crashīear markets usually put stress on weak projects. With most, if not all, of the cryptocurrencies trading in the red zone, investors have a hard choice to make between the coins to buy and the ones to sell. This announcement stressed coins that were yet to recover following last month’s Terra crash. On Sunday night, Celsius announced that it was halting withdrawals, swaps, and transfers because of extreme market conditions.

The global cryptocurrency market cap has fallen below $1 trillion from the peak of over $3 trillion recorded in November last year.

#Coins market how to

0 kommentar(er)

0 kommentar(er)